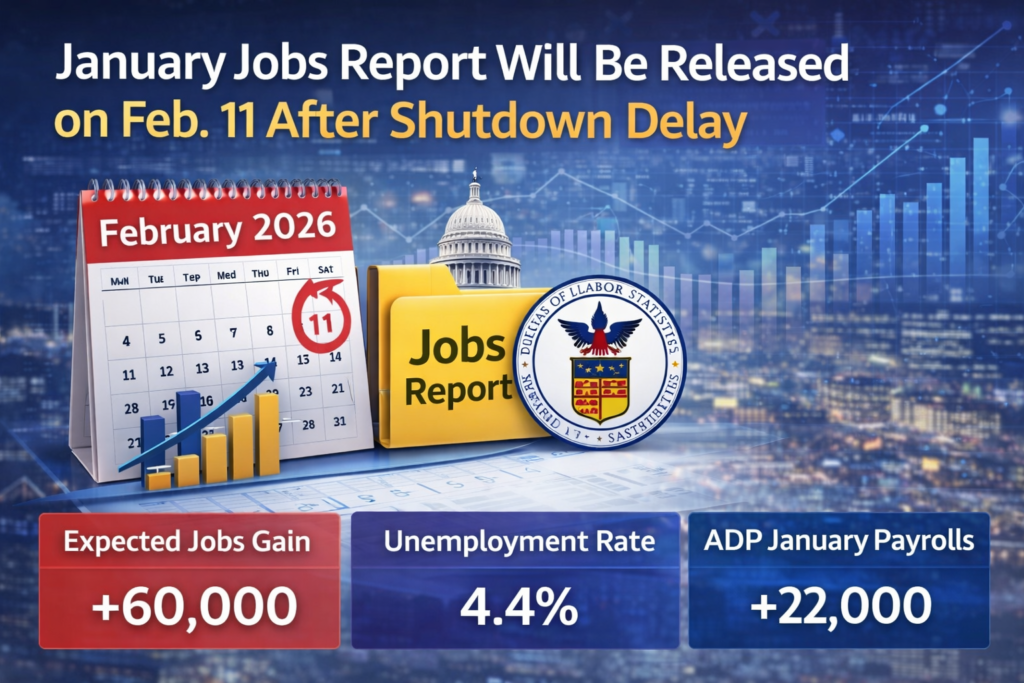

The January jobs report release date — one of the most closely watched indicators of U.S. economic health — will now be released on February 11 following delays caused by a brief government shutdown. The Bureau of Labor Statistics (BLS) confirmed the revised timeline, shifting multiple key labor and inflation reports that economists, investors, and policymakers rely on to gauge employment trends.

While the delay is short, the report carries significant weight. It provides a snapshot of hiring momentum, wage movement, unemployment stability, and overall labor market resilience — all critical factors shaping economic expectations in early 2026.

This guide explains what changed, what the data could reveal, how economists are interpreting early signals, and why this delayed release still matters for businesses, workers, and markets.

Why the January Jobs Report Was Delayed

Government shutdowns disrupt routine operations across federal agencies, including the Bureau of Labor Statistics. Although the shutdown was brief, it temporarily halted scheduled data processing and publication workflows.

As a result:

- The January nonfarm payrolls report moves from its original date to February 11

- The Job Openings and Labor Turnover Survey (JOLTS) shifts to Thursday of the same week

- The Consumer Price Index (CPI) release is delayed until February 13

- The real earnings report, tied to CPI, will follow the same adjusted schedule

These revisions are procedural rather than methodological — meaning the data collection remains intact, but publication timing has changed.

What the January Jobs Report Measures

The monthly jobs report includes several critical labor indicators:

Nonfarm Payrolls

Tracks total job gains or losses across major industries, excluding farm employment.

Unemployment Rate

Measures the percentage of people actively seeking work but unable to find jobs.

Wage Growth

Analyzes hourly earnings to assess income momentum and inflation pressure.

Labor Force Participation

Indicates how many working-age individuals are employed or actively job searching.

Together, these metrics form a comprehensive picture of labor market health and economic direction.

Economist Expectations Ahead of the January jobs report release date

Despite the scheduling change, analysts continue to forecast moderate labor market expansion.

According to consensus estimates:

- Expected job gains: ~60,000 positions in January

- December comparison: 50,000 jobs added

- Unemployment rate projection: steady at 4.4%

These projections suggest hiring remains stable but measured — consistent with a maturing economic cycle where companies prioritize efficiency and productivity over aggressive expansion.

Early Signals from Private Payroll Data

Private-sector payroll processor ADP released preliminary figures showing companies added 22,000 jobs in January — lower than expectations.

While ADP data doesn’t always perfectly align with government numbers, it signals:

- Slower hiring momentum

- Employer caution amid cost pressures

- Continued workforce recalibration

Economists caution against overinterpreting ADP figures alone, as government data uses broader sampling and methodologies.

Broader Labor Market Context

The delayed January report arrives during a period of transition in the labor market.

Key themes shaping employment dynamics include:

Hiring Moderation

Companies continue hiring but with tighter budget discipline.

Sector Divergence

Technology, healthcare, logistics, and professional services maintain selective growth, while cyclical industries remain cautious.

Wage Stabilization

Wage growth shows signs of normalizing after pandemic-era spikes.

Productivity Focus

Organizations increasingly prioritize skill specialization and output efficiency.

This environment reflects economic recalibration rather than contraction.

Why the Delay Matters — Even Briefly

A few days may seem insignificant, but financial markets and policy decisions often hinge on timely data releases.

The January jobs report influences:

- Federal Reserve policy outlook

- Market volatility

- Employer hiring strategies

- Wage negotiations

- Consumer sentiment

Investors and analysts closely monitor even minor scheduling changes because labor data anchors broader economic forecasting.

Consumer Price Data: A Companion Indicator

The CPI delay until February 13 is equally important.

Inflation and employment data together help policymakers evaluate:

- Wage-driven inflation risk

- Household purchasing power

- Interest rate positioning

Real earnings calculations — which measure income adjusted for inflation — depend on CPI timing, reinforcing the interconnected nature of economic indicators.

How Businesses and Job Seekers Should Interpret the Data

For Employers

Expect continued emphasis on targeted hiring, operational efficiency, and workforce optimization.

For Job Seekers

Stable unemployment suggests opportunities remain — especially for candidates with in-demand skills.

For Investors

Labor market resilience often supports economic confidence, though slower growth can temper rate expectations.

Historical Perspective on Data Delays

Government shutdown-related reporting delays are not unprecedented. Historically, such interruptions:

- Do not alter data accuracy

- Rarely impact long-term trends

- Primarily affect timing, not substance

Markets typically recalibrate quickly once reporting resumes.

What Happens Next

Once released, analysts will compare January figures against:

- December employment trends

- Sector-level hiring patterns

- Wage movement

- Participation rates

The results will inform projections for:

- Q1 economic growth

- Inflation trajectory

- Monetary policy signals

Conclusion

The January jobs report delay is procedural — not structural. When released on February 11, the data will offer a critical snapshot of early-year labor market momentum.

Expect moderate hiring growth, stable unemployment, and continued emphasis on workforce efficiency. While private-sector signals suggest cautious expansion, government data will provide a fuller perspective.

For businesses, policymakers, and job seekers alike, the upcoming release remains a key benchmark for understanding the direction of the U.S. economy in 2026.